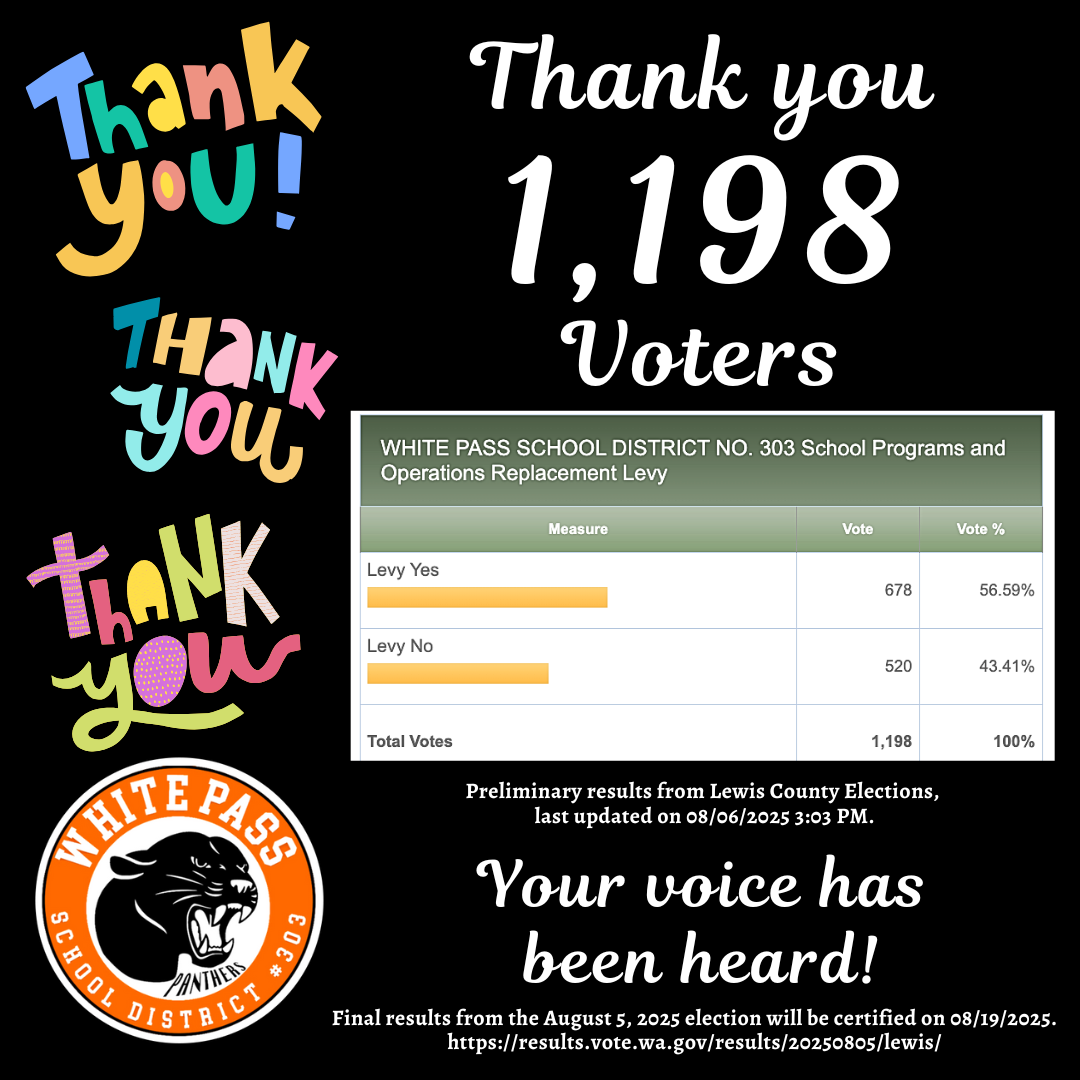

REPLACEMENT LEVY - August 5, 2025

OUR PANTHERS ARE OUR FUTURE

On August 5, 2025, White Pass School District is asking voters to consider a four-year replacement school programs and operations levy to sustain quality educational opportunities for all White Pass School District students.

This is a replacement levy, not an additional tax. Our district is growing, and our students deserve access to the same staffing and support that students in larger districts receive. If approved by voters, the levy would fund:

To inform residents, a brochure explaining this levy will be sent to all homes and post offices boxes within our three communities in mid July. See the Replacement Levy informational brochure here.

LEARN ABOUT PROPOSITION NO. 1

White Pass School District No. 303. School Programs and Operations Replacement Levy

The Board of Directors of White Pass School District No. 303 adopted Resolution No. 8-25, concerning a proposition for a replacement levy for education.

This proposition would authorize the District to levy the following excess taxes, replacing an expiring levy, on all taxable property within the District, for support of school programs and operations expenses not funded by the State, including teachers, support staff, technology, curriculum, athletics, and facility maintenance and operations:

What does Proposition No. 1 mean?

Proposition No. 1 asks voters to consider a replacement School Programs and Operations Levy, also known as an Educational Programs and Operations (EP&O), levy that helps fund educational programs, services, and daily operations in White Pass schools. If approved, the levy would continue local funding at an estimated rate of $0.79 for every $1,000 of a property’s assessed value.

The replacement EP&O levy would raise almost $4.8 million from 2026–2029 to support White Pass students. Actual year-to-year levy rates will be based on the total assessed property value across White Pass School District.

PROPOSED TAX RATE

What this levy will cost

The estimated rate for the replacement levy is $0.79 per $1,000 of assessed property value. This is a decreased rate to you from the current levy already in place.

This is a replacement levy. The rate calculation is the estimated assessment rate to property owners, not an additional tax. Remember, we can only collect the total amount of funds voters approved for the next four years.

What you currently pay

In February 2021, White Pass District voters passed a levy at $1.29 per $1,000 of assessed land value. That funding is set to expire at the end of 2025. This new rate replaces the expiring levy and would fund critical programs at a decreased, fixed rate of $0.79 per $1,000.

For example if you own a:

• $300,000 home, your new tax rate would be $19.75 per month.

• $400,000 home, your new tax rate would be $26.33 per month.

• $500,000 home, your new tax rate would be $32.92 per month.

What this looks like over time

This proposition is for years 2026–2029, and we are the only local district that approved a fixed rate for all four years. This means the proposed tax rate stays the same through 2029 and does not increase. Other districts have increasing tax rates per collection year.

Our total levy amount is locked in. If your property value increases over the next four years, the rate you owe per $1,000 drops. We cannot collect more funds than voters approve.

HOW SCHOOL FUNDING WORKS

Washington’s school funding model

Washington’s funding model serves all schools, but its one-size-fits-all approach doesn’t always meet the needs of small districts like White Pass.

State funding doesn’t cover programs like athletics and extracurriculars, and it falls short on funding counseling, CTE, arts, staffing, and maintenance. All these programs and services rely on local levies.

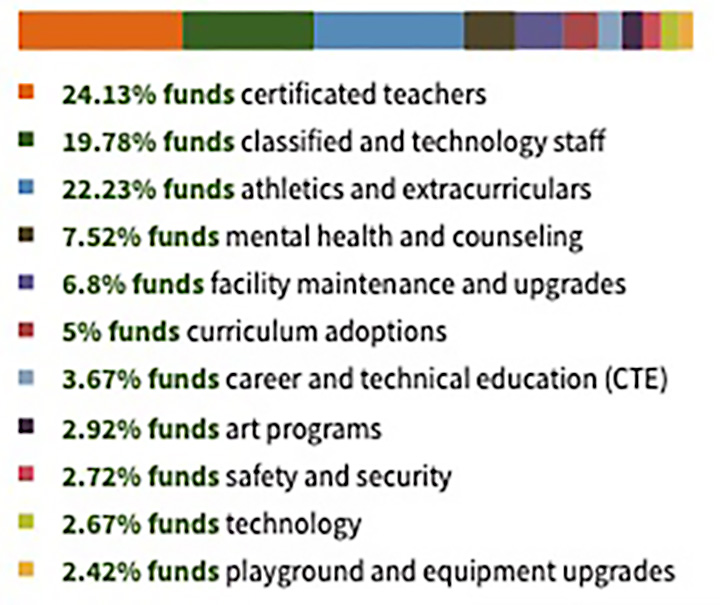

HOW OUR LEVY DOLLARS ARE USED

The spending breakdown

We use levy dollars to fund programs and services in these ways:

HOW WE COMPARE TO OTHER DISTRICTS

The average school levy amount across Lewis County is $1.46 per $1,000. Our asking rate is $0.79 per $1,000, which is much lower than the surrounding schools' average.

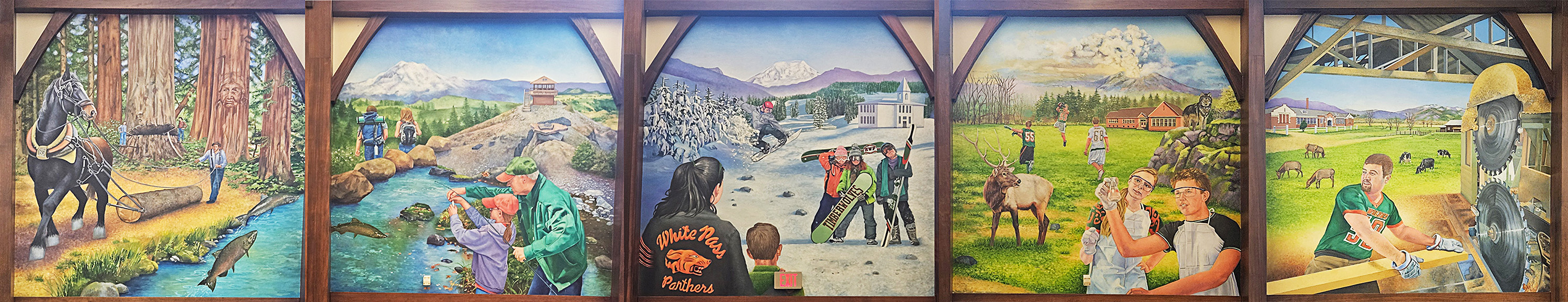

GET TO KNOW OUR SCHOOL

White Pass School District was established in 1947 and serves the communities of Packwood, Randle and Glenoma. Our campus is centrally located in Randle and contains both the Elementary School and the Jr/Sr High School, plus playgrounds, ballfields, a complete high school track and football stadium.

FREQUENTLY ASKED QUESTIONS

LOCAL LEVIES SUPPORT OUR SUCCESS.

The White Pass School District proposed levy will replace the expiring levy.

The levy provides support for our educational programs, athletics, career and technical education and also allows the district to maintain low class sizes in our primary grades.

These and more are just a few of the needs paid for by local levy dollars.